On November 2, 2021, Virginia’s Democratic party lost their majority in a full Republican sweep of the offices of Governor, Lieutenant Governor, Attorney General, and the House of Delegates.

With all of the complicated questions raised since the Cannabis Control Act (CCA) was passed, reenactment was never going to be easy, even under a Democratic administration. Now a Republican-controlled House raises the question of whether Virginia’s commercial cannabis market will exist at all.

Will the Cannabis Control Act be reenacted?

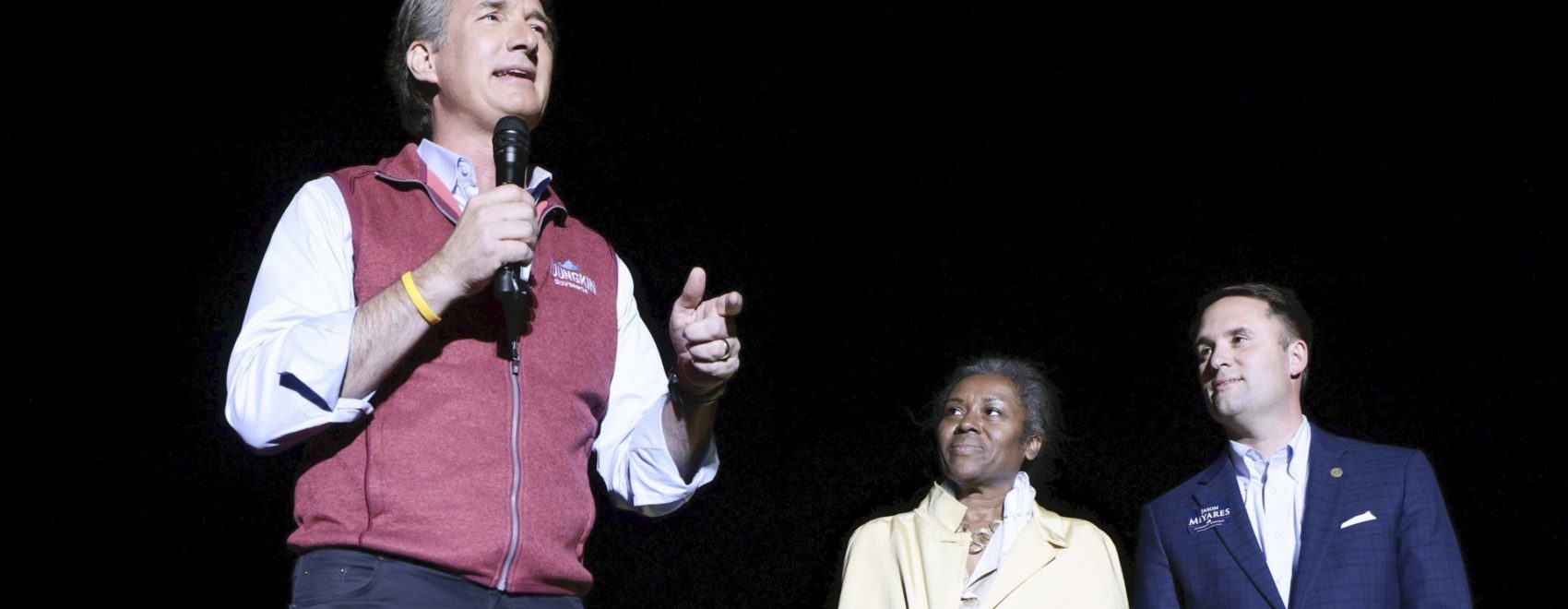

Governor-elect Glenn Youngkin stated that he will not repeal the CCA, citing the billions in revenue that will help “[restore] excellence in education.” His support of the market is crucial as Republicans now hold the majority in the House of Delegates. This is significant for a number of reasons, but particularly since the CCA passed on strict party lines earlier this year at 53-44-2.

Importantly, the Senate remains in Democratic control. However, Lieutenant Governor Fairfax did have to break a tie to pass the CCA 21-20. Now that Republican Winsome Sears holds the gavel, she alone could determine the survival of Virginia’s commercial cannabis market. Sears has said, “I’m not against medicinal marijuana. I’m just really worried about recreational marijuana.”

What place will social equity hold in the CCA, if reenacted?

From preferences in the application process, loan programs, and community reinvestment, to sealing and expungement of criminal records, social equity measures drove the Cannabis Control Act. It is possible that these measures will be contentious sticking points for reenactment under the new majority, where a first-come, first-served licensure scheme is favored.

Will the legislature expedite the timeline for commercialization?

The Cannabis Oversight Commission suggested that the Virginia Cannabis Control Authority (VCCA) use the pharmaceutical permit processors and their existing operations to begin selling recreational marijuana to the public sooner than January 1, 2024.

During their last meeting, the Commission debated the creation of an “incubator model,” whereby each pharmaceutical permit processor will take on a social equity-qualifying business and give them a head start in the retail market before commercial sales go live in 2024.

Whether this measure makes it into the new bill remains to be seen. Although, some Republicans have expressed support of expediting the commercial timeline as a solution to the black market.

Will there be more or less preference for industrial hemp processors in the licensure process?

Virginia’s industrial hemp processors could retain their ability to vertically integrate under the new majority. Removing this preference could be interpreted as eliminating a lucrative stream of business for rural Virginians and rural localities, where some of the largest hemp farms in the state have taken root.

Industrial hemp processors will need to begin developing a strategy to combat any efforts to strip them of their ability to vertically integrate.

Will the license caps change?

Compared to Colorado that has 14.1 marijuana retail stores per 100,000 people, Virginia will only have 4.7 per 100,000. Even with those comparisons in mind, it’s unclear how the license caps may change, and how any changes to the caps, particularly to cultivation, could impact the supply chain and deflate the projected revenue stream.

Will additional referenda be allowed?

We could see a scenario in which localities could have the power to ban not just retail, but the cultivation and processing of marijuana too. It is also possible that the legislature could extend the ability of localities to hold a retail referendum beyond the current deadline of December 2022.

Businesses need to stay ahead of any efforts to gain support for additional referenda and be aware of how the timeline could impact revenue and jeopardize their business.

Will criminal records still be sealed or expunged?

Virginia State Police has already sealed 333,000 simple possession and 64,000 misdemeanor marijuana distribution charges, and expunged thousands of possession of marijuana without a prescription records. What remains to be seen is how the General Assembly will handle the resentencing of those currently imprisoned for the now-repealed crimes.

Reenacting the Cannabis Control Act will be a massive undertaking, complicated by the change in majority. However, the promise of billions of dollars in revenue could be enough to ensure that legislators will support Virginia’s future commercial cannabis market.

It will be difficult to predict which policies will survive, if any at all, but we do know that you need a team on your side that can foresee how any changes will affect your ability to do business and advocate to the right people on your behalf.

Gentry Locke Consulting is Virginia’s premiere cannabis consulting firm, delivering proactive and comprehensive services in regulatory compliance, business consulting, capital acquisition, and legislative affairs to help clients maximize their opportunities in Virginia’s newest billion dollar industry.